In late January 2026, global bitumen markets experienced a broad-based upward trend, with prices increasing across major producing and consuming countries. Markets including Iran, China, India, Japan, South Korea, Southeast Asia, and Australia all reported firm price movements, supported by steady construction activity and improving demand conditions.

The upward momentum was driven by stable crude oil prices, consistent export demand, and controlled supply levels. In several markets, higher logistics, packaging, and freight costs further contributed to price increases, while suppliers maintained disciplined output, limiting excessive availability and supporting firmer pricing.

Overall, market sentiment remained constructive and cautiously bullish, with buyers accepting higher price levels amid expectations of continued demand recovery. Although price movements were mostly gradual rather than sharp, the prevailing trend pointed clearly toward further strengthening in the near term, supported by solid fundamentals and balanced market dynamics.

In addition, regional market participants reported increased price resistance from suppliers, as sellers showed less willingness to offer discounts amid firmer demand expectations.

Import-dependent markets faced higher replacement costs, while exporters focused on maintaining higher price levels supported by forward sales and stable order books. As a result, the overall pricing environment strengthened further, reinforcing the view that bitumen markets had entered a sustained upward phase rather than a short-term fluctuation.

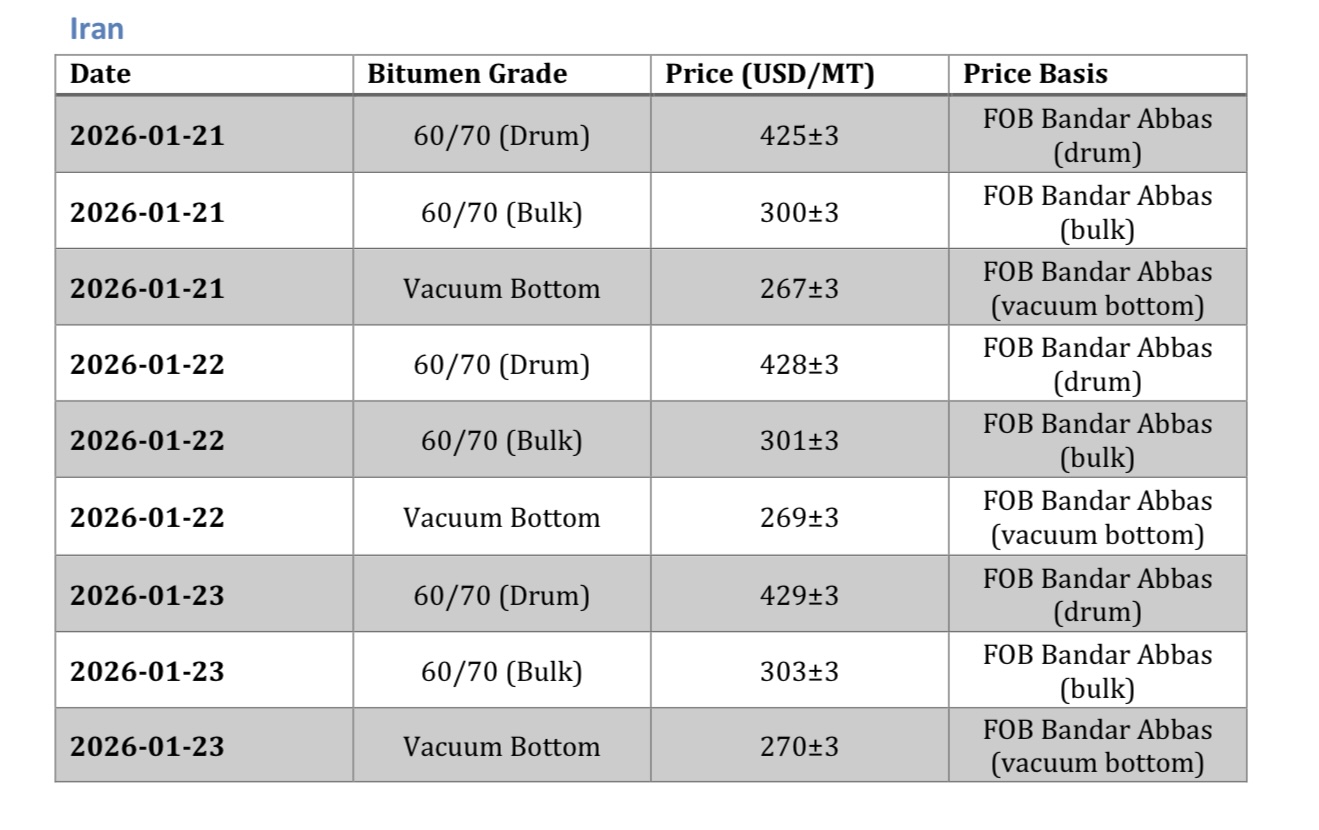

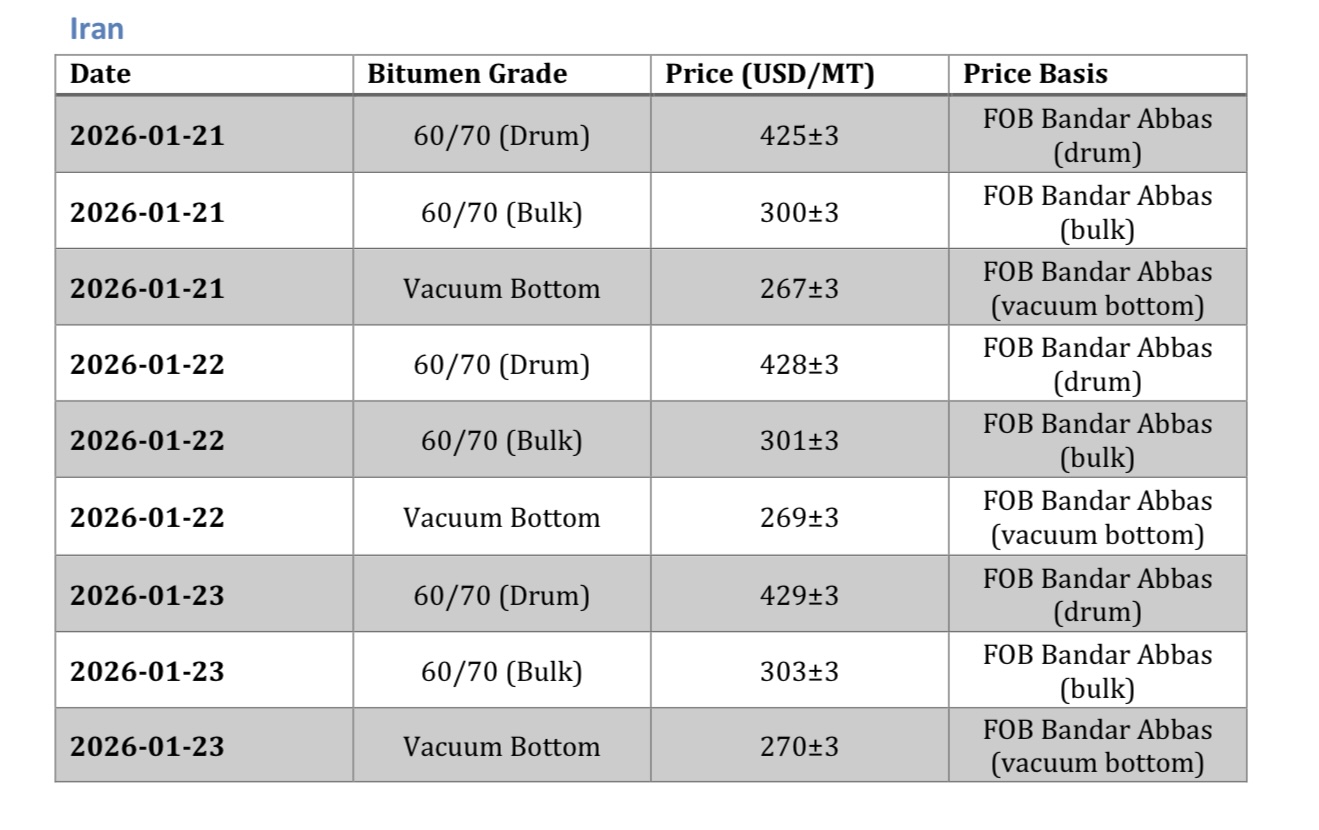

Compared with previous weeks, Iranian bitumen prices showed a clear upward trend. Bulk prices moved higher, while drum and packaged grades recorded more noticeable increases, supported by rising packaging costs and stronger export demand. Overall, the market reflected firm supply-demand fundamentals and improving buyer sentiment, pushing prices upward without sharp volatility.

Compared with previous weeks, Iranian bitumen prices showed a clear upward trend. Bulk prices moved higher, while drum and packaged grades recorded more noticeable increases, supported by rising packaging costs and stronger export demand. Overall, the market reflected firm supply-demand fundamentals and improving buyer sentiment, pushing prices upward without sharp volatility.

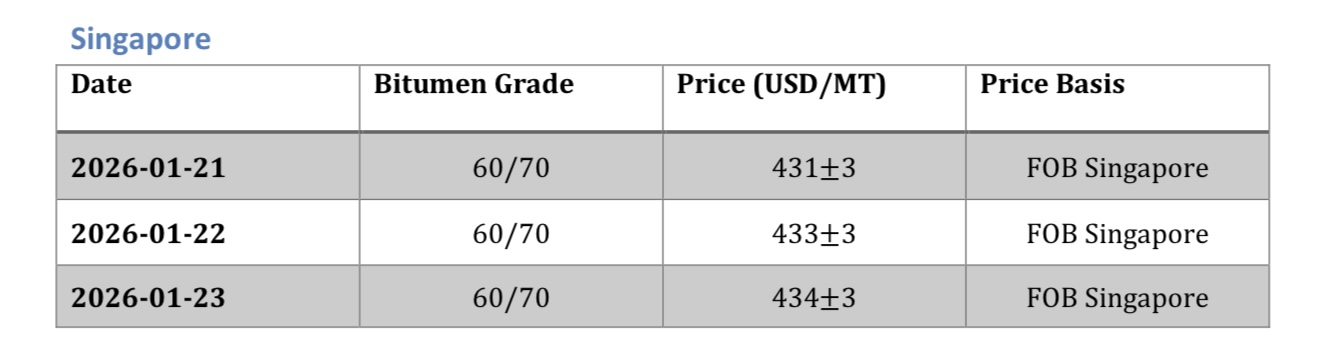

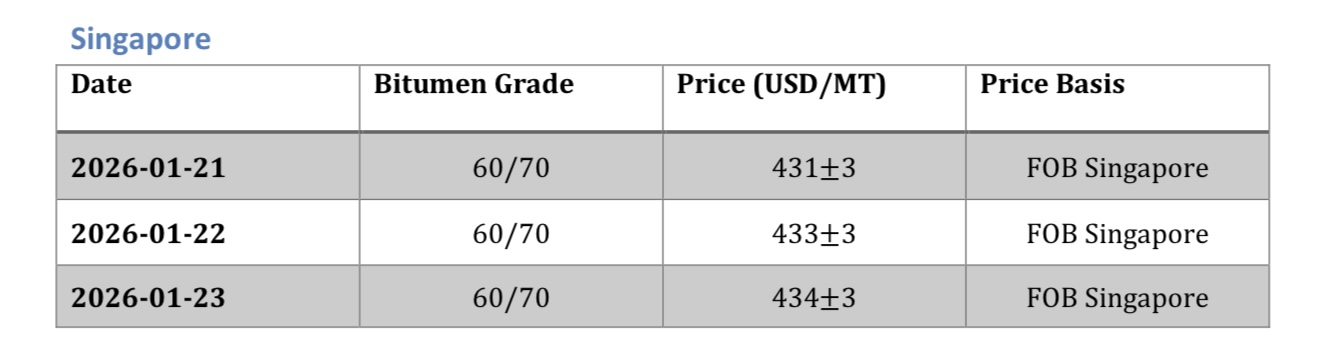

During this period, Singapore bitumen prices trended upward, supported by steady regional demand and tightening spot availability. Unlike earlier weeks, buyers showed renewed interest, allowing prices to gradually firm up. Limited arbitrage pressure still kept movements controlled, but the overall direction remained positive and increasing.

During this period, Singapore bitumen prices trended upward, supported by steady regional demand and tightening spot availability. Unlike earlier weeks, buyers showed renewed interest, allowing prices to gradually firm up. Limited arbitrage pressure still kept movements controlled, but the overall direction remained positive and increasing.

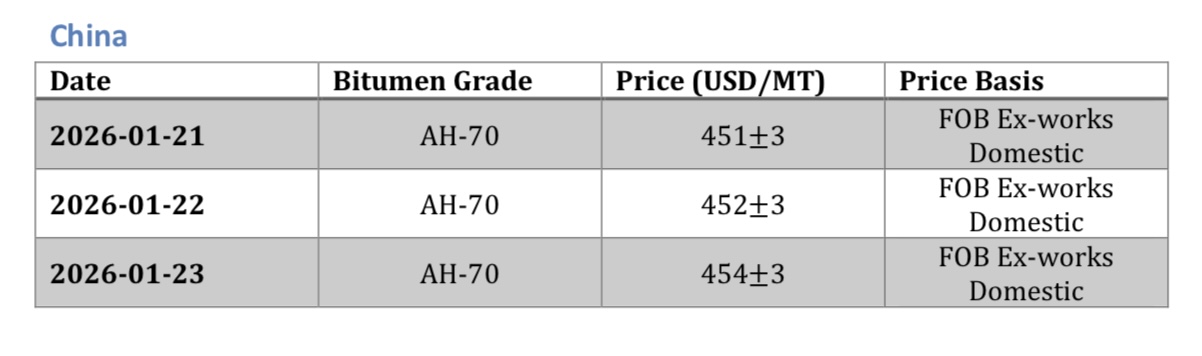

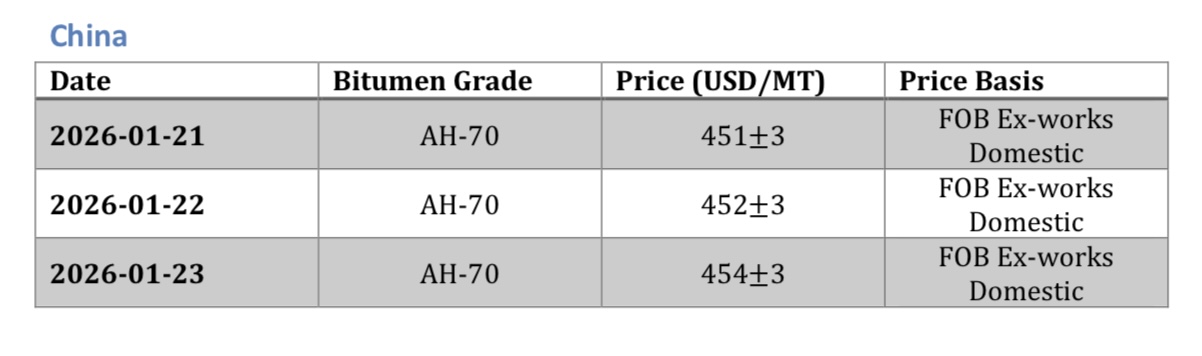

China’s bitumen market in late January 2026 moved on an upward path, with futures and spot prices rising toward the upper end ton range. Compared to early January, prices posted incremental gains, driven by steady domestic demand and balanced-to-tight supply, reinforcing an upward market sentiment.

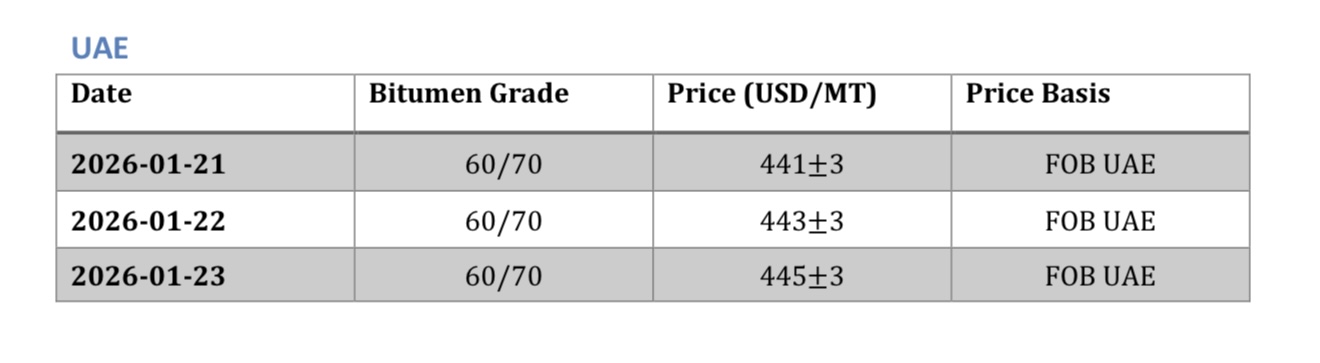

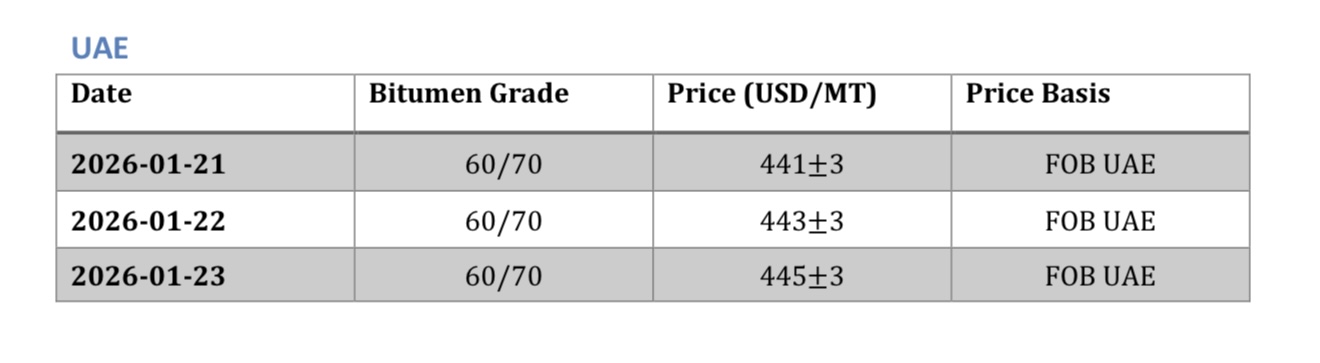

In late January 2026, UAE bitumen prices edged higher, moving within the upper end of the mid-$360s to low-$380s per metric ton range. Improved regional demand and firmer Middle East market sentiment contributed to incremental price gains, signaling a more constructive pricing environment.

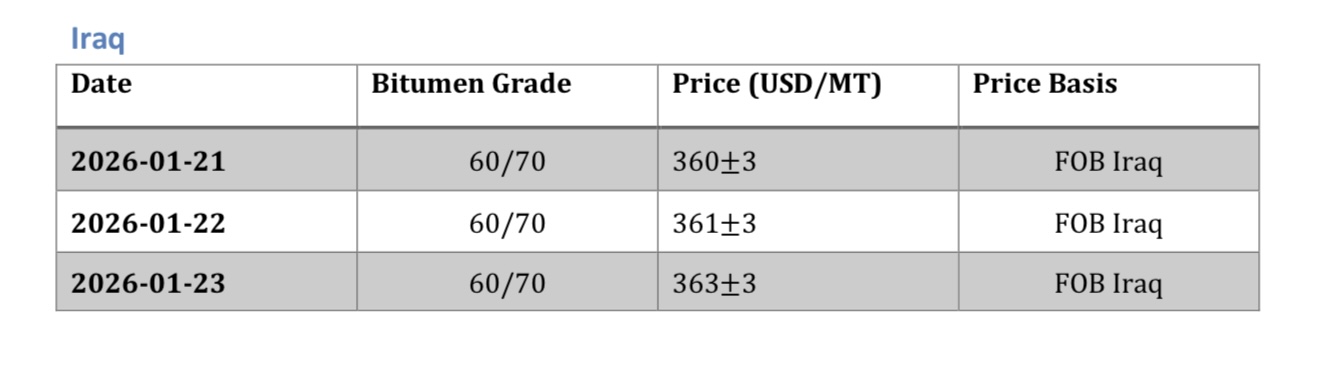

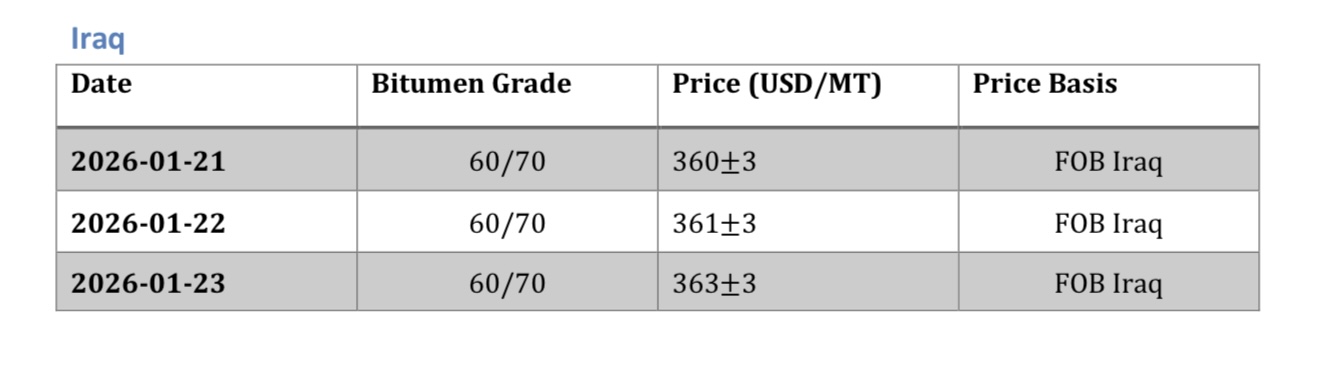

Iraq’s bitumen market in late January 2026 recorded higher export pricing, with 60/70 grade FOB levels rising toward the upper end of the $360–363/MT range. Strengthening export demand and tighter availability supported continued price appreciation throughout the period.

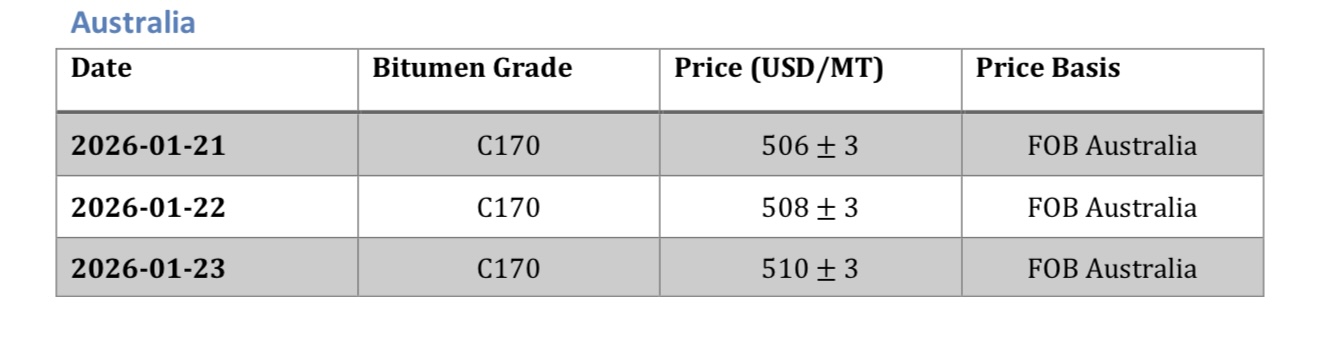

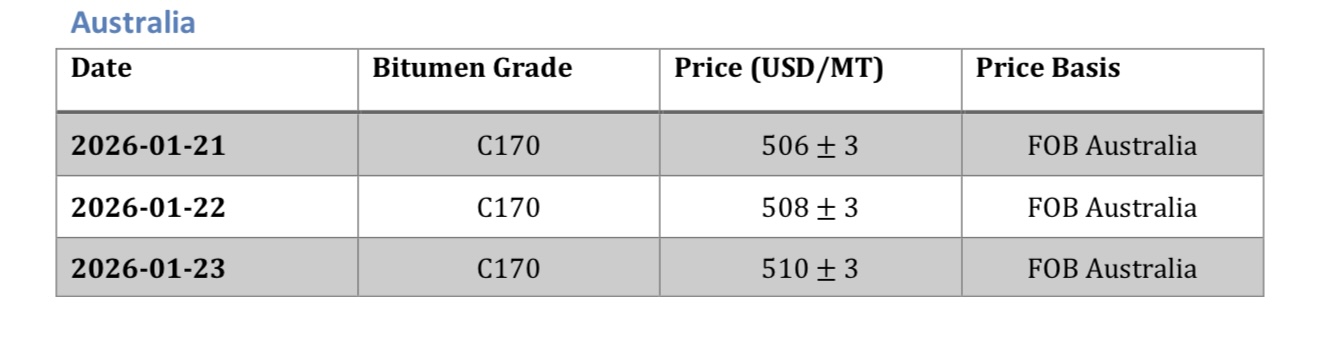

Australia’s bitumen market in late January 2026 experienced steady price increases, with imported CIF levels moving higher around the low-$510/MT range. Firm construction demand and Australia’s dependence on imports supported consistent upward

price movement, influenced by global crude trends and stable freight costs.

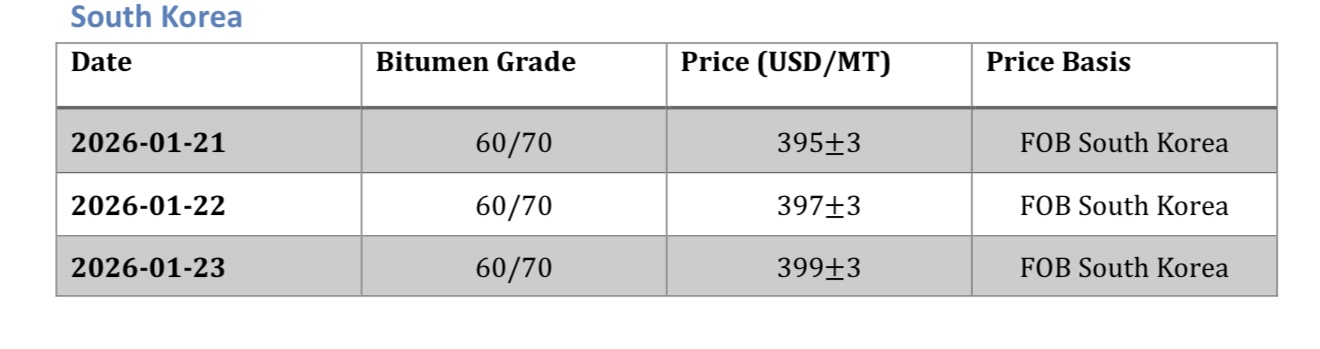

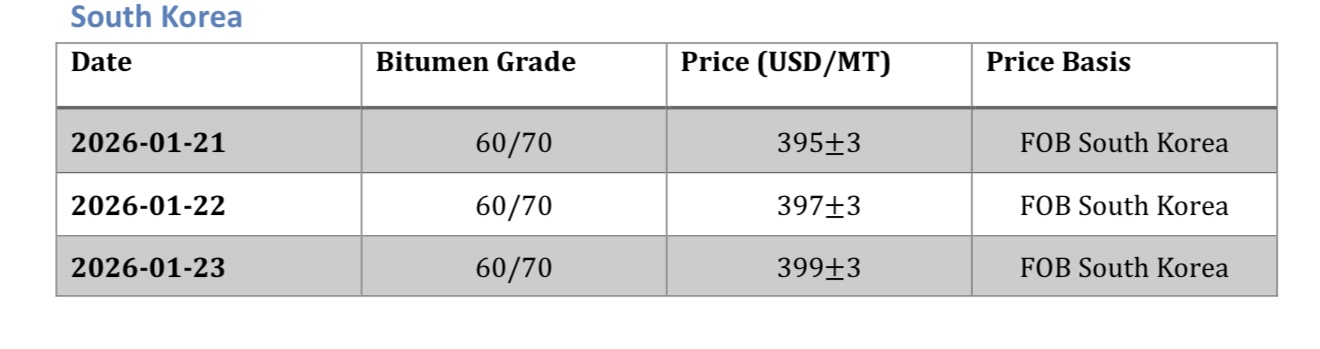

South Korea’s bitumen export market in late January 2026 showed increasing price strength, supported by steady Asian demand and limited supply fluctuations. FOB prices firmed within the $395-399/MT range, reflecting a clear upward bias driven by ongoing infrastructure activity in the Asia-Pacific region.

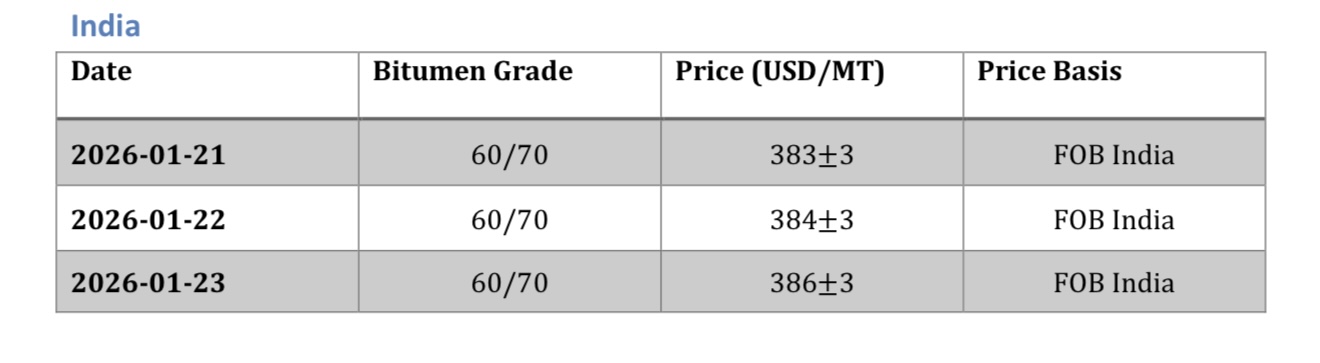

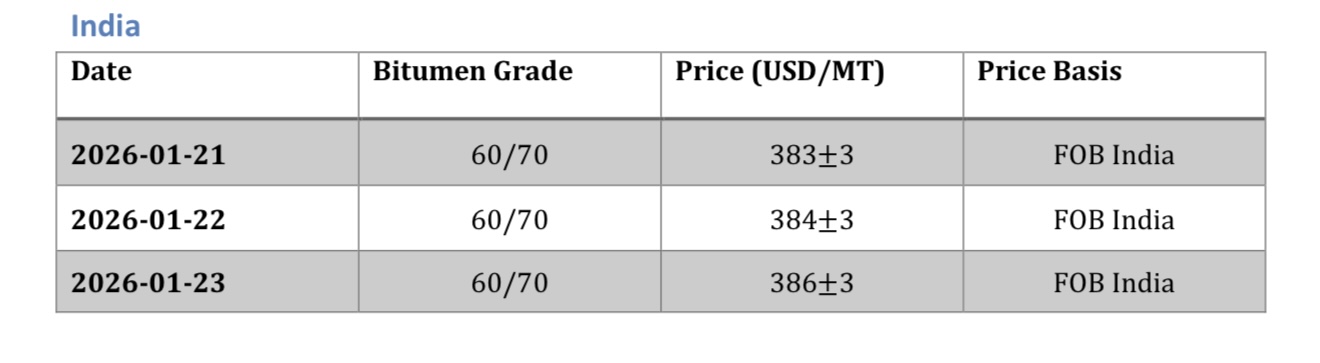

India’s bitumen prices in late January 2026 showed a gradual upward trend, rising toward the mid-$386s per metric ton. Seasonal demand improvement, combined with stable refinery pricing and supportive crude fundamentals, led to moderate but sustained price increases across the market.

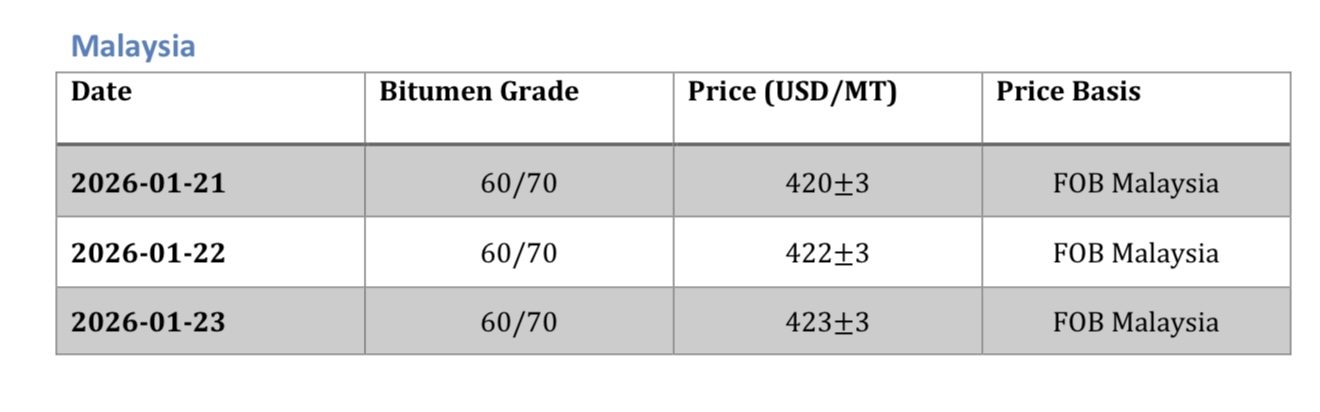

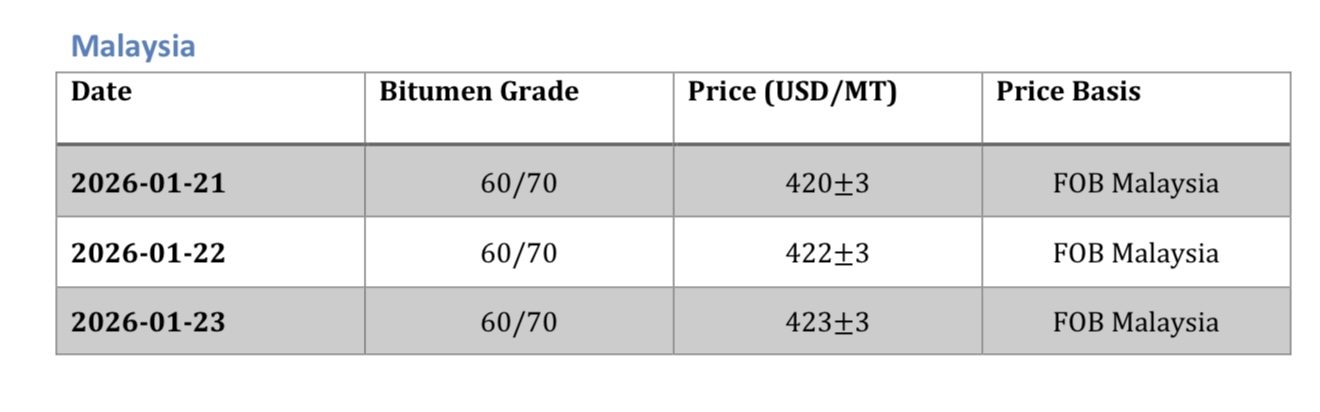

Malaysia’s bitumen prices in January 2026 continued their upward momentum, climbing from early January levels. Strong infrastructure demand and reliance on imported grades supported prices, which firmed toward the mid-$423s per metric ton. This increase reflects healthy post-holiday trading activity and supportive crude oil fundamentals.

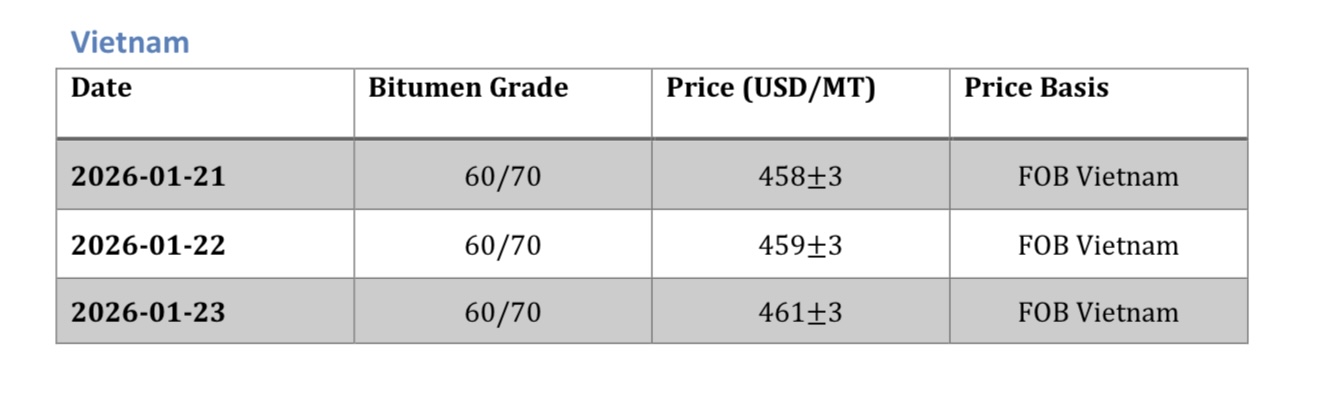

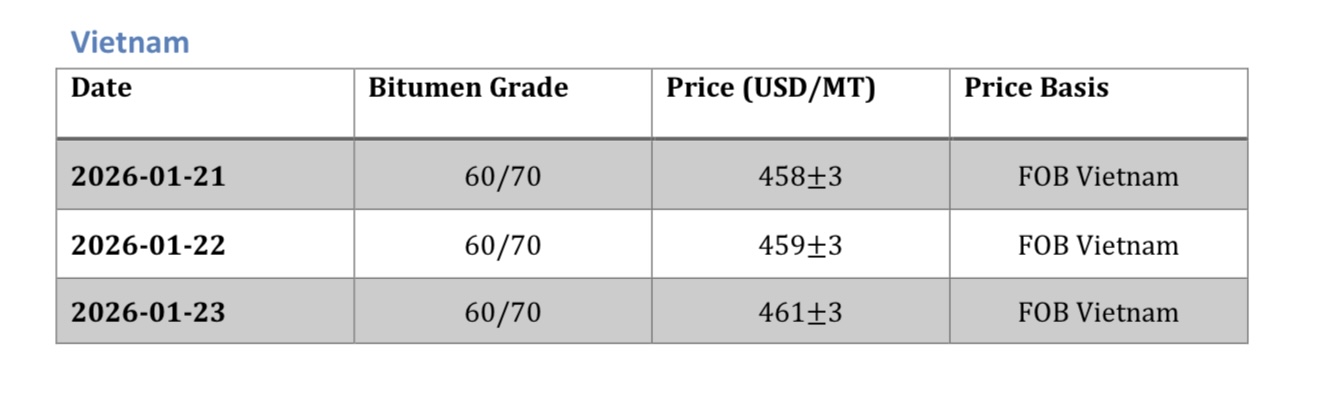

Vietnam’s bitumen market in late January 2026 moved higher, with FOB prices for 60/70 grade increasing toward the $458–461/MT range. Strong infrastructure demand and active import interest encouraged suppliers to push prices upward, resulting in a firm and positive market trend.

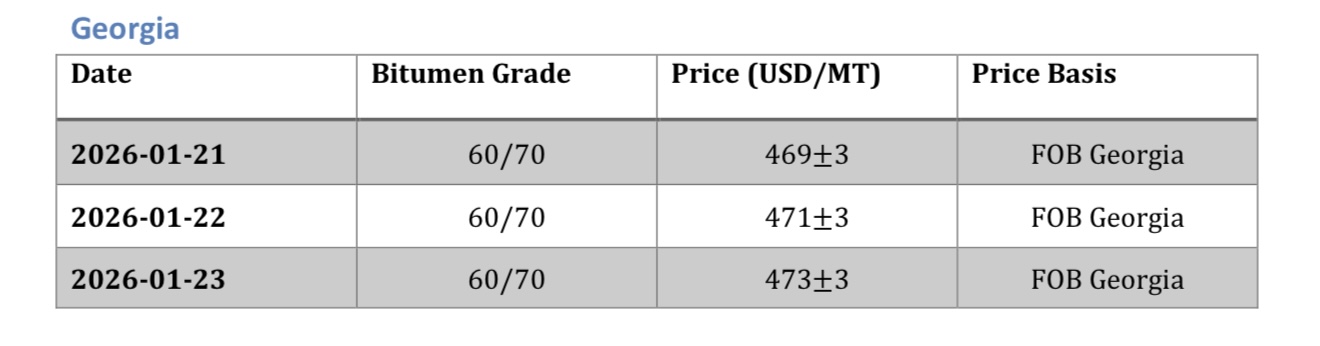

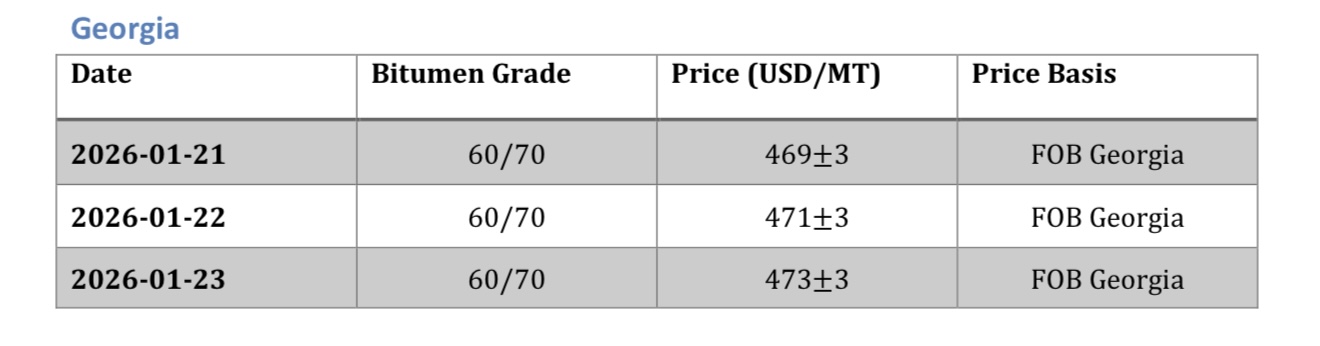

Bitumen prices in Georgia recorded a moderate increase, supported by rising import costs and stronger demand. Sellers adopted firmer pricing strategies. The market outlook stayed positive.

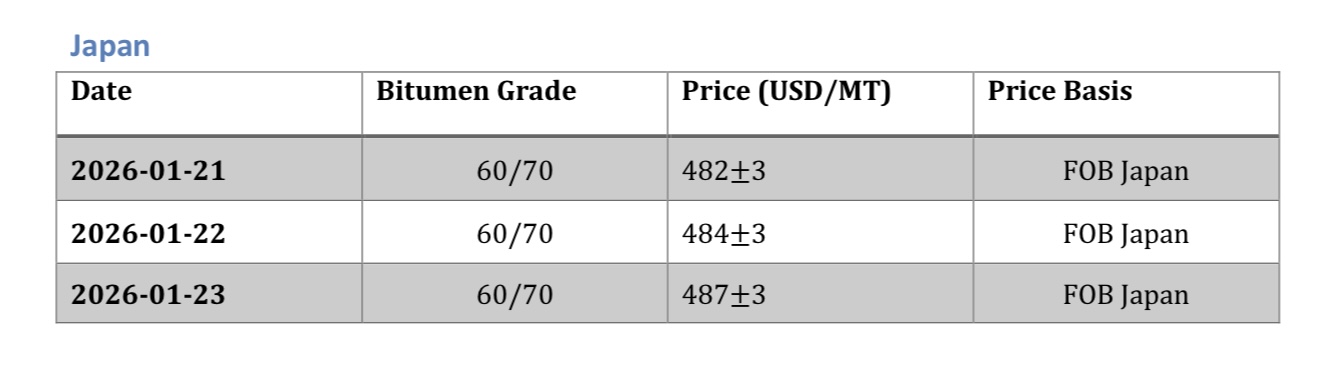

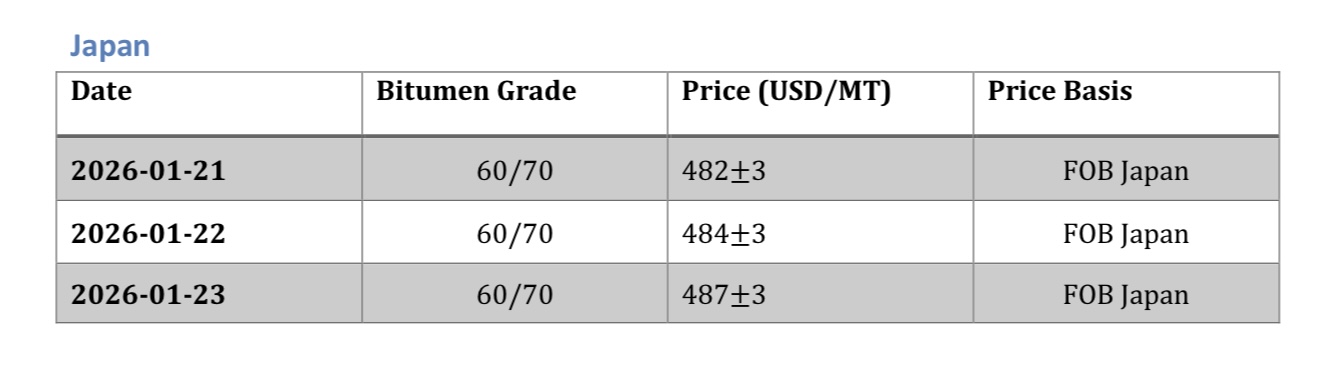

Japan’s bitumen export prices in late January 2026 maintained a firm upward trend, holding within the $482–487/MT FOB range with increasing support from stable domestic demand and disciplined refinery output. Regional benchmarks and trade flows helped sustain gradual price increases during 21–23 January.

Compared with previous weeks, Iranian bitumen prices showed a clear upward trend. Bulk prices moved higher, while drum and packaged grades recorded more noticeable increases, supported by rising packaging costs and stronger export demand. Overall, the market reflected firm supply-demand fundamentals and improving buyer sentiment, pushing prices upward without sharp volatility.

Compared with previous weeks, Iranian bitumen prices showed a clear upward trend. Bulk prices moved higher, while drum and packaged grades recorded more noticeable increases, supported by rising packaging costs and stronger export demand. Overall, the market reflected firm supply-demand fundamentals and improving buyer sentiment, pushing prices upward without sharp volatility. During this period, Singapore bitumen prices trended upward, supported by steady regional demand and tightening spot availability. Unlike earlier weeks, buyers showed renewed interest, allowing prices to gradually firm up. Limited arbitrage pressure still kept movements controlled, but the overall direction remained positive and increasing.

During this period, Singapore bitumen prices trended upward, supported by steady regional demand and tightening spot availability. Unlike earlier weeks, buyers showed renewed interest, allowing prices to gradually firm up. Limited arbitrage pressure still kept movements controlled, but the overall direction remained positive and increasing.