International bitumen trade during mid-September 2025 has portrayed a combination of steady refinery runs and regionally diverse price patterns. Market fundamentals in Asia, the Middle East, Europe, and Africa depict how infrastructure demand, procurement schedules, and refinery economics all interact to drive short-term trade volumes.

In East Asia and China, throughput at refineries was relatively steady, but prices were rather volatile since inventories were substituting for market demand. Institutional development, including the introduction of new financial instruments, also suggested a shift in an environment for forward price discovery.

Regionwide across South and Southeast Asia, municipal tenders and roadworks continued to be the key drivers of demand. Small cargo transactions contributed premiums due to the need to deliver against project timetables, and this illustrates how tender calendars can change regional prices in the near term.

In the Middle East, competitively priced FOB cargoes and refinery restarts supported Red Sea, South Asian, and African buyers. Seasonal demand for infrastructure also created intermittent peaks in procurement activity.

The European market remained bearish, with heavy fuel oil spreads and seasonal outages keeping prices soft. Africa and the CIS, however, were confronted with logistical challenges that delayed infrastructure developments, although Gulf-originated supplies offered a invaluable alternative for buyers.

Why This Matters

These trends reveal how the bitumen market is influenced not only by refinery capacity but by infrastructure capital cycles, regional tender cycles, and global logistics. As development works span broader across regions, participants must anticipate how even slight localized supply changes can affect global ranges of prices and availability.

The whole article, which is available to our subscribers to our journal only, discusses:

•Detail regional split with price benchmarks.

•Detailed analysis of tender activity and procurement trends.

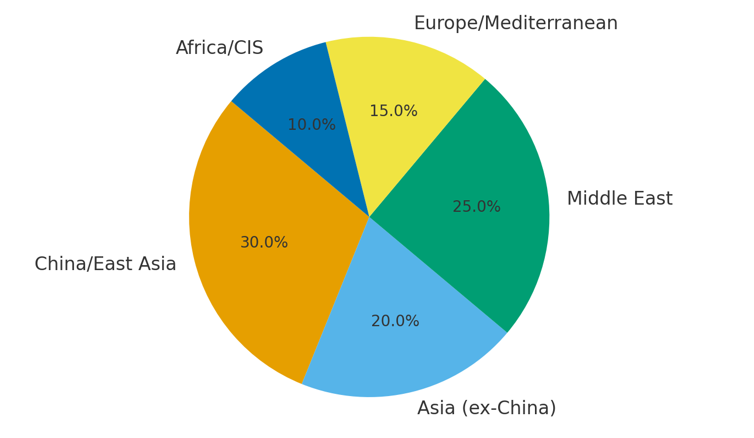

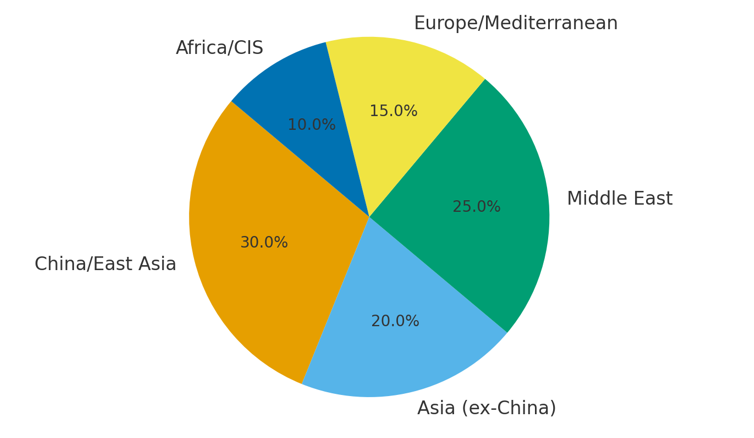

•Charts highlighting regional influence on trade flows.

•View on how institutional policy and refinery economics drive long-term market trends.

Subscribe to view the complete mid-September 2025 Bitumen Market Analysis and keep your business ahead with key price and supply developments.

For subscription, contact us on whatsapp:

+447831423117