Trending

Where to Begin with Bitumen Import and Export?

Introduction:

Engaging in the international trade of bitumen requires a solid understanding of relevant regulations. In bitumen import and export, familiarity with customs laws and the rules of the Ministry of Industry is of great importance, as no goods—not even bitumen—can legally enter or exit a country without passing through the appropriate customs procedures.

Understanding these regulations can help reduce costs, save time, and simplify customs procedures. The “Export and Import Regulations” law, approved by a designated government authority in each country, sets the main framework for foreign trade. This law, along with the customs tariff schedules, is regularly updated to ensure the proper processing of exports and the importation of essential goods.

In every country, imported and exported goods fall into three categories:

1.Permitted Goods: Goods that do not require a license for import or export, provided all general rules are followed.

2.Conditional Goods: Goods that can only be imported or exported with a proper license. Bitumen falls under this category.

3.Prohibited Goods: Goods whose import or export is forbidden by law.

Bitumen Export:

To begin exporting bitumen, one must have some basic yet essential knowledge. Here, WPB Journal intends to outline the steps for those interested in becoming bitumen and petroleum derivatives exporters.

1. Market Analysis and Understanding Bitumen Products

•Types of Bitumen: These include petroleum (refinery) bitumen, natural bitumen, cutback bitumen, emulsion bitumen, and more. Each type has its specific use and market. The following link provides a comprehensive overview of bitumen types:

https://bitumenmag.com/News/everything-about-bitumen-1

•Bitumen Market Analysis: It is important to identify which countries have high demand for bitumen and what types they use. For example:

•In India, 60/70 bitumen is the most commonly used type, considered the main standard for road construction and paving. With its medium viscosity, it suits India’s hot and humid climate well.

•For China, depending on the regional climate and construction needs, multiple types are used. However, 70/100 and 60/80 grades are the most commonly consumed. Additionally, polymer-modified and cutback bitumen have good markets there.

If you are planning to export bitumen to China, note that China uses its own specific standards based on penetration and viscosity grading systems. The following link offers a detailed introduction to bitumen concepts:

https://bitumenmag.com/News/everything-about-bitumen-1

Also, keep in mind that bitumen is usually imported into China in drums or in bulk, and it must be accompanied by a valid Certificate of Analysis (COA). Exporters must be familiar with Chinese GB standards and send product samples for quality testing.

China’s Main GB Standards for Bitumen:

GB/T 494–2016

Penetration Grade Asphalt

•Covers physical specifications for standard penetration bitumen (such as 60/70, 70/100).

•Includes penetration, softening point, viscosity, flash point tests, etc.

•Equivalent to ASTM D946 and EN standards in Europe.

GB/T 15180–2018

Polymer Modified Bitumen (PMB)

•Technical standard for bitumen modified with polymers like SBS or EVA.

•Includes criteria for elasticity, thermal stability, and crack resistance.

GB/T 2000–2006

Cutback Asphalt

•Covers cutback bitumen, which is diluted with kerosene or similar solvents.

•Suitable for cold climates or temporary construction projects.

GB/T 25180–2010

Bitumen Emulsion

•Technical specifications for emulsified bitumen (bitumen mixed with water and emulsifiers).

•Includes tests for stability, viscosity, loading, and adhesion.

JT/T 279–2020

Transport and Packaging of Bitumen

•Guidelines for packaging and transporting bitumen in bulk, drums, or containers.

Aside from China and India, African countries are also lucrative destinations for this “black gold.”

When exporting bitumen to African countries, the following factors should be taken into account.

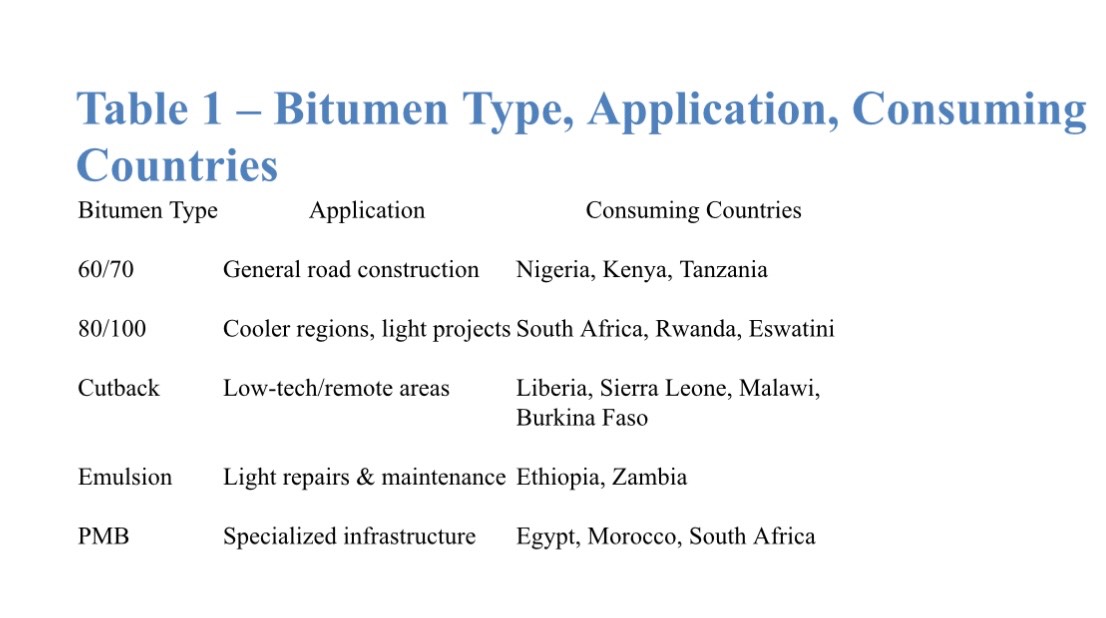

Common Types of Bitumen Used in African Markets:

– 60/70 Bitumen

•The most widely used bitumen type in Africa, especially in equatorial and tropical countries

•Mainly used in road construction and pavement projects

•Commonly consumed in countries such as:

Nigeria, Kenya, Tanzania, Ghana, Uganda

– 80/100 Bitumen

•Used in cooler regions or for lighter construction projects

•Consumed in southern or mountainous countries such as:

South Africa, Rwanda, Eswatini

– Cutback Bitumen

•Suitable for remote areas or projects lacking advanced equipment

•Since it does not require intense heating, it’s used in low-resource or emergency projects

•Commonly used in lower-income or less-developed countries like:

Malawi, Liberia, Sierra Leone, Burkina Faso

For Market Research and Product Understanding:

One of the most efficient ways to research market demand and product insight—including bitumen—is using the Trade Map website. It provides detailed data on global imports and exports, including trade volume, market share, transaction dates, and product demand by country.

Link: https://www.trademap.org/Index.aspx

2. Analyze Competitors and Pricing in Target Markets

2-1 Competitor Identification

Start by thoroughly identifying your competitors. In the bitumen market, competitors generally fall into three categories:

•Domestic Producers who also engage in direct exports. A detailed investigation is necessary.

•Individual Exporters or Trading Companies that handle the export of bitumen.

•Importers (if applicable) in certain countries that might import processed bitumen or raw materials.

Data to Collect on Competitors:

•Bitumen production capacity or volume per shipment, and their ability to supply various destinations

•Types of bitumen produced and packaging options (e.g., jumbo bags, bulk, drums), and trade volume

•Domestic and export pricing—especially from key reference countries such as South Korea, Singapore, India, Iran, Germany, the U.S., Canada, France, etc.

•Marketing and sales strategies, especially regarding bitumen value, transportation methods, and payment terms

2-2 Understanding Bitumen Pricing Structures

Bitumen prices are influenced by multiple factors:

Domestic Factors:

•Crude oil price, which is affected by supply/demand, OPEC/OPEC+ policies, futures markets (e.g., New York, London, Dubai), geopolitical and economic conditions, and USD exchange rates

•Currency exchange rates (USD/EUR for exports)

•Customs duties and taxes

•Government subsidy policies

•Domestic transportation costs

External Factors:

•Global prices of crude oil and petroleum products

•FOB bitumen prices at key international ports (e.g., Singapore, Fujairah, Bandar Abbas)

•Competition with other exporting countries (e.g., India, Bahrain, Russia, Singapore, etc.)

2-3 Target Market Analysis

Since your goal is bitumen export, you must thoroughly study and identify your target markets. The following aspects should be analyzed carefully and strategically:

1.Domestic demand levels

2.Domestic bitumen production capacity

3.Infrastructure and transportation development

4.Import tariffs and regulations

5.Existing competitors in the target market

6.Logistics considerations – including shipping routes, transportation costs, and port accessibility

Country-Specific Market Analyses for Bitumen Export

Bitumen Export to China

•Demand: Very high; China is the world’s largest energy consumer and the second-largest bitumen consumer.

•Domestic Production: High, but still requires imports.

•Applications: Road construction, highways, urban development.

•Main Competitors: Bahrain, UAE, Singapore, South Korea.

•Iran’s Advantage: Geographical proximity via southern ports (Bandar Abbas – Shanghai).

•Note: Highly sensitive to quality and strict regulations.

Bitumen Export to India

•Demand: Very high and growing.

•Domestic Production: Exists but cannot fully meet demand.

•Target Market: Developing infrastructure; over 40,000 km of road projects planned by 2030.

•Main Competitors: Iran, Bahrain, Saudi Arabia, and UAE.

•Advantage: Strong trade ties with Iran and lower transportation costs from the Persian Gulf.

•Note: Requires competitive pricing and BIS-approved quality standards.

Bitumen Export to Vietnam

•Demand: Growing, especially in urban and transportation development projects.

•Domestic Production: Very limited; relies heavily on imports.

•Main Competitors: Thailand, South Korea, Singapore.

•Iran’s Advantage: Lower pricing and access to an emerging market.

•Note: Logistics and compliance with local standards are important.

Bitumen Export to Malaysia

•Demand: Medium to high; multiple ongoing infrastructure and urban projects.

•Domestic Production: Covers part of the demand.

•Main Competitors: Singapore, South Korea, China.

•Iran’s Advantage: Iranian bitumen has competitive quality and pricing.

•Note: Requires strong trade relations and reliable suppliers to enter the market successfully.

Bitumen Export to Thailand

•Demand: High, driven by construction and tourism-related projects.

•Domestic Production: Exists but insufficient for large-scale projects.

•Main Competitors: China, South Korea, UAE.

•Note: Stringent quality standards and preference for long-term contracts.

Bitumen Export to Kenya

•Demand: Increasing; multiple road and infrastructure projects underway.

•Domestic Production: Very limited; highly import-dependent.

•Main Competitors: India, UAE, Saudi Arabia.

•Iran’s Advantage: Competitive pricing and ability for steady supply.

•Challenge: Logistics and transportation from the Persian Gulf to Africa.

Bitumen Export to South Africa

•Demand: High; a mature and developed market.

•Domestic Production: Exists, but some demand is met through imports.

•Main Competitors: UAE, Bahrain, South Korea.

•Challenge: Competing on both price and quality; environmental regulations are strict.

•Note: Market requires legal engagement, customs clearance, and brand registration.

Bitumen Export to Tanzania

•Demand: Growing, driven by roadwork and the development of Dar es Salaam Port.

•Domestic Production: None or very limited.

•Main Competitors: India, UAE, China.

•Iran’s Advantage: New market with access via Bandar Abbas to Dar es Salaam.

•Challenges: Political stability, transportation quality, and banking coordination.

2.4 Price Sources and Active Bitumen Industry Platforms

For accurate market and price analysis, use the following resources:

•International platforms:

•ICIS

•Argus Media

•BitumenMag

•Commodity exchanges in respective countries

•National customs databases

•Websites of major bitumen production companies

•Industry-specific networks and professional associations

3. Licensing and Company Registration for Bitumen Export

Once you’ve assessed the market, pricing, and competitors, the next step is to secure the necessary licenses and establish your export operations.

3.1 Register a Trading Company

Specify import/export as the main business activity.

3.2 Obtain Economic Code and Business Card (Export License)

Required Documents:

•Trade activity license (if applicable)

•ID and personal documents

•Economic code

•Company registration documents (for legal entities)

Note: If you don’t want to obtain your own business card, you may use one issued by a trading company.

3.3 Register in the Integrated Trade System

You must register and activate your business role in the Iran Trade Promotion System to complete all customs and commercial procedures.

3-4. Special Permits or Certificates Required for Bitumen Export

To export bitumen, the following documents and certifications are typically required:

•Certificate of Analysis (COA) – Issued by an accredited laboratory confirming product quality

•MSDS (Material Safety Data Sheet) – Required by some countries for safety compliance

•Packing List and Commercial Invoice – Basic shipping and billing documents

•Certificate of Origin (CO) – Issued by the Chamber of Commerce to certify the origin of goods

•Bill of Lading (BL) – Required for sea freight shipments

3-5. Export Declaration via the Customs System

After preparing all necessary documents, issuing the proforma invoice, and receiving a purchase order from the foreign buyer, exporters must register their export information on the customs platform. A formal export declaration will be issued through this system.

3-6. Shipping and Insurance Procedures

•Coordinate shipping (typically by sea, in drums or bulk)

•Arrange cargo insurance if necessary to mitigate risks during transit

3-7. Financial Settlement and Currency Exchange

To repatriate export earnings (if mandated by the Central Bank), exporters must go through official systems such as NIMA or use export-for-import offsets. However, many bitumen exporters prefer more flexible methods, including barter deals or informal settlements.

Important Notes:

•Bitumen exports must meet international standards.

•The type of bitumen (e.g., 60/70 or 80/100) and packaging method (bulk, drums, boiler tanks, jumbo bags, etc.) significantly affect price and export terms.

•It’s highly recommended to involve third-party inspectors like SGS or Bureau Veritas to verify product quality.

•Main destination markets for Iranian bitumen: India, UAE, African nations, China, Central Asia, and more.

4. Product or Buyer Sourcing

If you’re an exporter:

Sign agreements with refineries or bitumen producers. In Asia, some key companies include:

•Iranian producers: Pasargad Oil, Jey Oil, Black Gold, Hormozan, Akam, Phoenix Iraq, Shimi Tejarat Naghsh Jahan

•Chinese producers: Sinopec, CNPC, Shandong Qilong Chemical

•Indian producers: Indian Oil Corporation Limited, Bharat Petroleum Corporation Limited, Shell Bitumen India

If you’re an importer:

Find a reliable foreign supplier from Iran, Bahrain, UAE, or other countries with strong bitumen industries.

5.Finding Buyers or International Suppliers

•Participate in international oil and bitumen exhibitions (you can request a full list from WPB’s website).

•Use B2B platforms such as:

•Alibaba

•TradeKey

•Send professional business correspondence to potential clients.

6.Contracts and Shipping

•Draft a formal export contract (it’s recommended to consult a legal expert).

•Choose a payment method: advance payment, letter of credit (LC), or telegraphic transfer (TT).

•Decide on shipment method (drums, bulk tankers, or bags) and arrange proper cargo insurance.

7. Customs and Trade Documentation

•Prepare essential documents: invoice, packing list, certificate of origin, certificate of analysis, bill of lading, etc.

•Declare goods at customs and work with a professional customs broker.

•Take advantage of export tax exemptions, where applicable.

This article was prepared to provide a complete guide to bitumen export procedures. By mastering these steps, you can enter the market and begin exporting. If this is your first or second experience, it’s strongly advised to seek assistance from legal advisors and trading companies.

📌 The second edition of this guide—focused on professional-level bitumen exporting—will be published soon on this site.

If the Canadian federal government enforces stringent regulations on emissions starting in 2030, the Canadian petroleum and gas industry could lose $ ...

Following the expiration of the general U.S. license for operations in Venezuela's petroleum industry, up to 50 license applications have been submit ...

Saudi Arabia is planning a multi-billion dollar sale of shares in the state-owned giant Aramco.