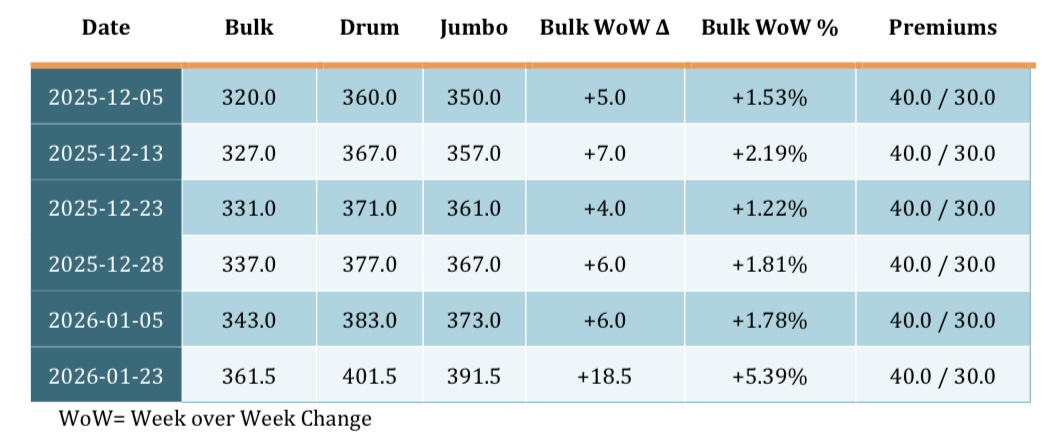

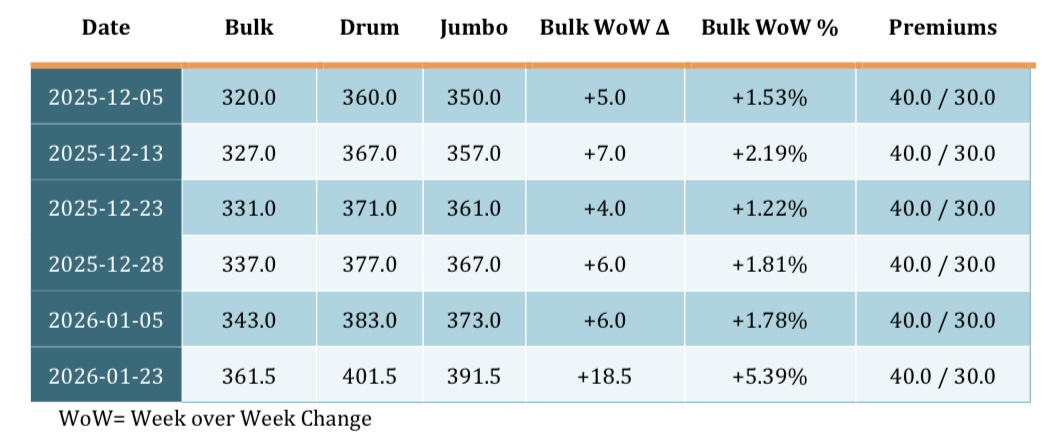

Units: USD per metric ton (USD/MT)

Basis: FOB Iraq

Grade: 60/70

Important note on data handling: The last observation is a reported range; for modeling and charts, the midpoint is used (e.g., 360–363 → 361.5). Where Drum/Jumbo are not explicitly quoted in the source, this report uses a standard packaging premium approach (Drum ≈ Bulk + 40; Jumbo ≈ Bulk + 30) consistent with the provided table. The analysis focuses on directionality, relative moves, and risk ranges—not a single-point certainty.

1) Dataset

2) Executive Takeaways (What matters commercially)

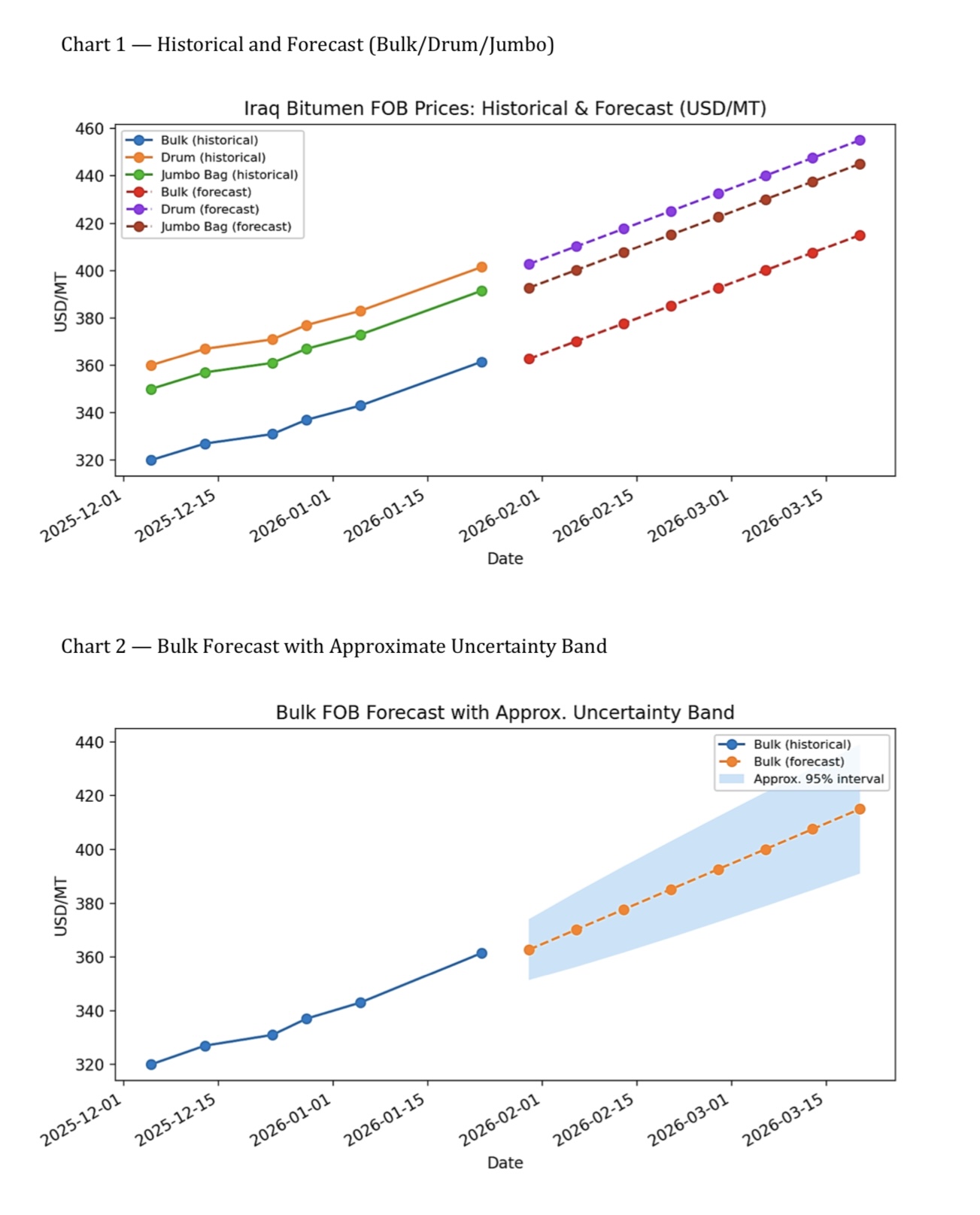

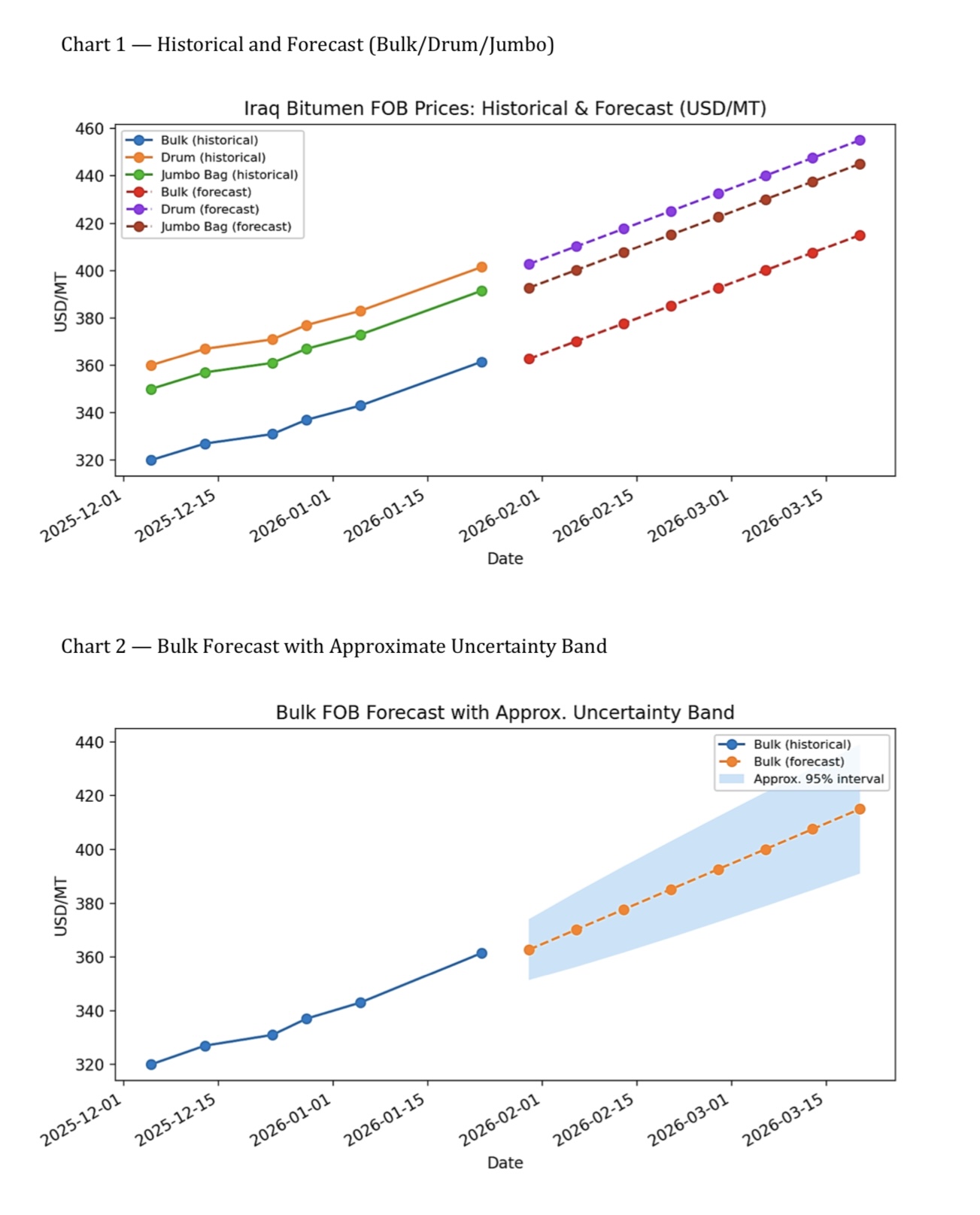

• The market shows a clear and persistent upward staircase with minimal drawdowns. That profile is typical of a tightening supply/demand balance where sellers re-anchor offers higher after each clearing level.

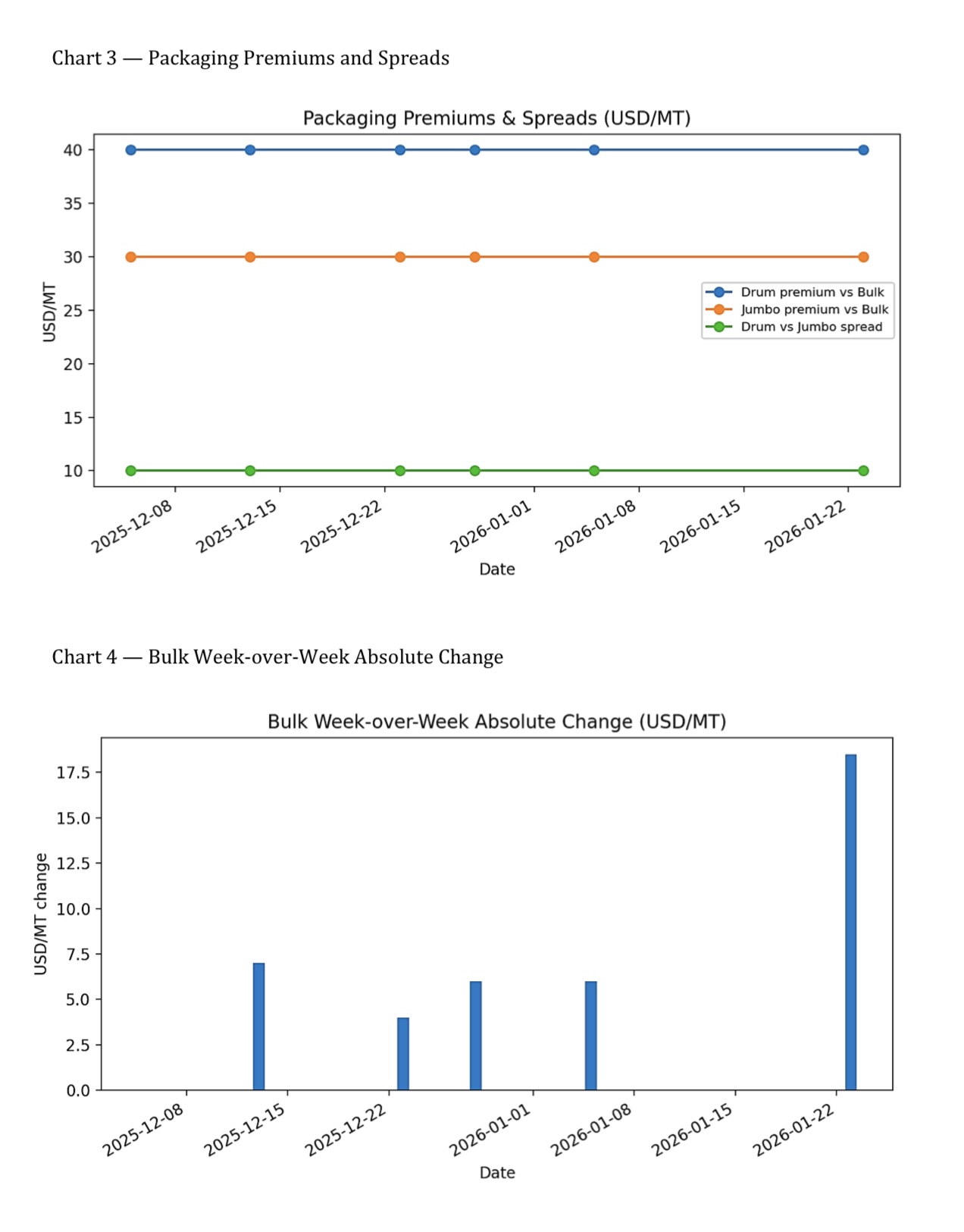

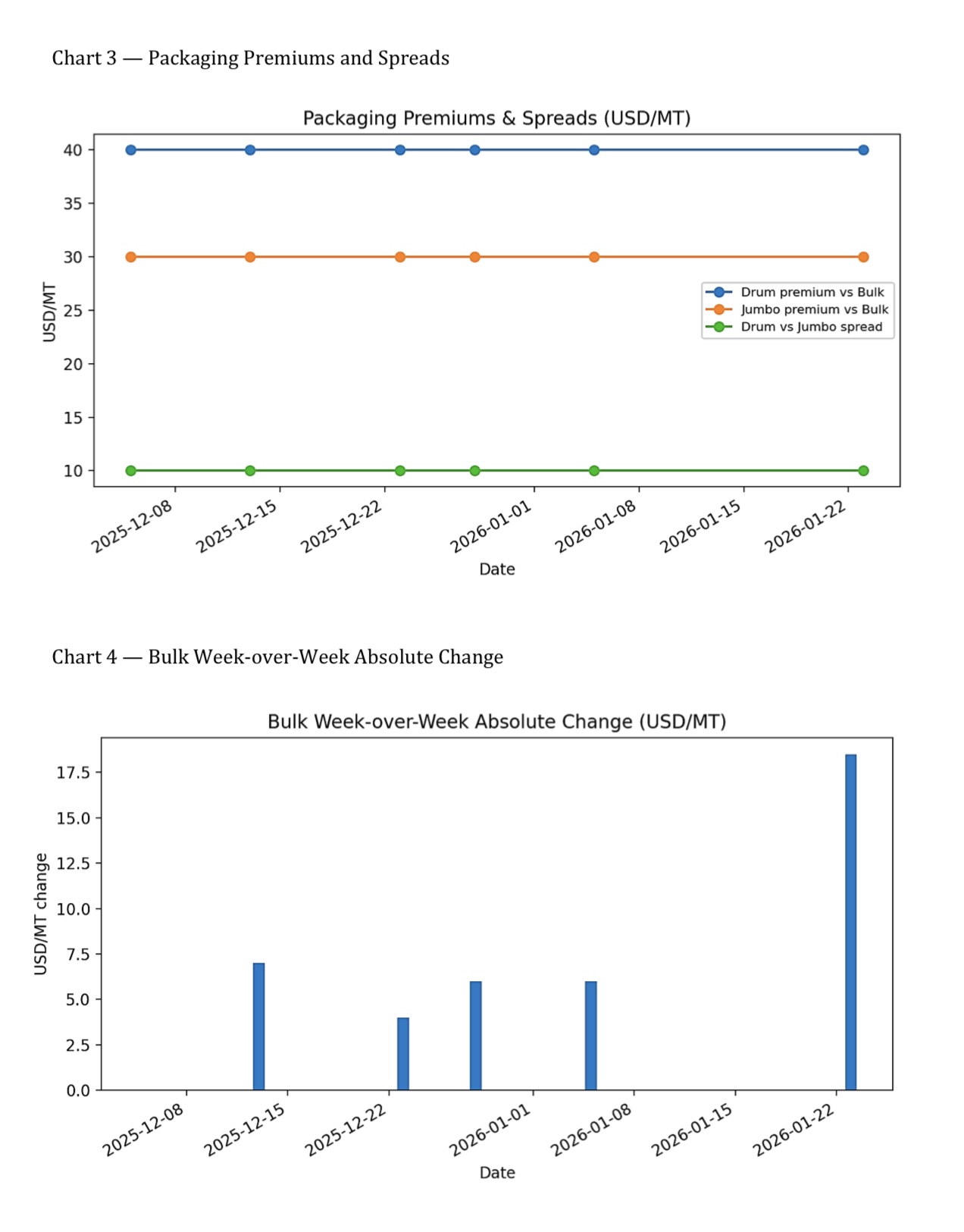

• Packaging differentials (Drum and Jumbo vs Bulk) are stable in the sample; therefore, most of the price risk is bulk-driven.

• The late-January step is the key inflection point: it signals either (a) a meaningful shift in willingness to pay, (b) reduced spot availability, or (c) both.

3) Quantitative Trend Anatomy (Bulk)

Over the observed window, Bulk rises from 320.0 to 361.5 USD/MT (+41.5 USD/MT, +12.97%). The average level is 336.6, with a sample standard deviation of 14.6.

Interpretation: The move is large relative to the short observation window, implying a market re-pricing rather than normal noise. The absence of meaningful retracements suggests offers are being accepted at successively higher anchors.

4) Packaging Economics: Bulk vs Drum vs Jumbo

Median implied packaging premiums in the dataset:

• Drum premium vs Bulk: ~40.0 USD/MT

• Jumbo premium vs Bulk: ~30.0 USD/MT

• Drum vs Jumbo spread: ~10.0 USD/MT

Commercial meaning:

• Bulk is the reference ‘market value’ and carries the core directional risk.

• Packaged products mainly add logistics and handling value (packaging, palletizing/handling, container utilization effects, labor, and sometimes financing/time costs).

• When premiums are stable (as here), switching between Drum and Jumbo is often an operational decision rather than a price-call.

5) Price Micro-Structure (Why the steps matter)

The stepwise pattern (multiple small increments rather than one shock) often implies:

1) Sellers test the market with slightly higher offers; if cargoes still clear, the new level becomes the reference.

2) Buyers are ‘forced to follow’ due to limited alternatives, urgent program needs, or higher replacement cost expectations.

3) Liquidity is present but disciplined—transactions happen, yet the marginal seller does not need to discount.

In this dataset, the jump into the last point is notable: it compresses multiple weeks of incremental appreciation into a single step. In many commodity markets, such a move correlates with a temporary supply squeeze, a strong tender cycle, or a structural re-anchoring of offers.

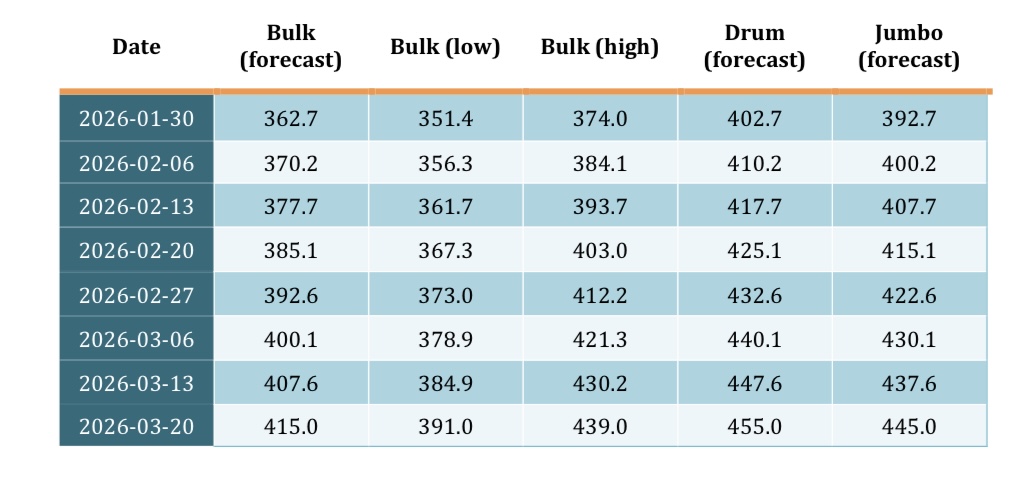

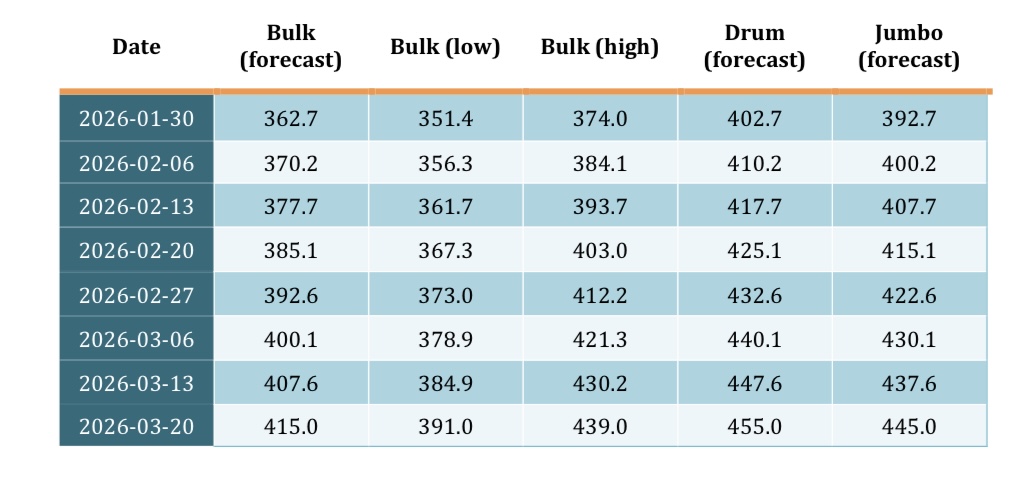

6) Forecast (Baseline) + Risk Ranges

Model: Linear trend baseline on Bulk (time index). Because the dataset is short, this approach is used as a disciplined ‘first-pass’ forecast. An approximate 95% band is computed from historical residual dispersion and widened with horizon.

How to use: For buying, treat the lower band as a ‘good entry’ area if supply is available. For selling, treat the baseline and upper band as guidance for defending higher offers in tight windows.

6.1 Forecast Purpose and Context

The primary objective of this forecast is not to produce a single “exact” number, but rather to provide a structured forward-looking pricing corridor that reflects:

The momentum visible in the recent price series

The market’s re-anchoring behavior

Packaging stability (Bulk vs Drum vs Jumbo)

Short-term tightening dynamics typical of Middle East bitumen flow

Given that Iraq FOB pricing is often driven by export availability and regional demand pull, forecasting must be approached as a scenario-based probability framework, rather than a fixed-point prediction.

6.2 What the Data Tells Us About Direction

From early December to late January, Bulk FOB rose from:

320 USD/MT → ~361.5 USD/MT

This represents:

+41.5 USD/MT increase

Approximately +13% appreciation in under two months

This is not a random fluctuation — it is a structural upward repricing.

Such a move typically indicates:

Strengthening buyer acceptance at higher levels

Reduced seller urgency to discount

Tightening spot supply conditions

A market transitioning from “balanced” to “firm”

The shape of the curve matters:

This is not a volatile zig-zag market

It is a stepwise upward staircase, which is characteristic of disciplined sellers progressively lifting offer levels.

6.3 Baseline Forecast Model (Trend Continuation Case)

Given limited observations, the most defensible baseline approach is a time-trend continuation model, assuming:

No major supply shock

Demand remains stable-to-firm

Export flows continue normally

Packaging premiums remain structurally stable

Under this baseline, Bulk prices are projected to drift upward gradually over the next 6–8 weeks.

Baseline Expected Bulk FOB Rang

The model implies Bulk prices could trade around:

368–375 USD/MT over the next 4–8 weeks

This represents continued appreciation, but at a slightly smoother slope than the late-January jump.

6.4 Forecast Levels for Packaged Material

One key feature of the dataset is that packaging premiums are stable:

Drum ≈ Bulk + 40 USD/MT

Jumbo ≈ Bulk + 30 USD/MT

Therefore, packaged forecasts are largely mechanical extensions of the Bulk trajectory:

Projected Packaged Price Corridors

If Bulk trades in the 370–375 range:

Drum FOB likely trades around 410–415 USD/MT

Jumbo FOB likely trades around 400–405 USD/MT

This is important commercially:

> Most of the future price risk is not packaging-driven — it is bulk-driven.

Packaging is a cost add-on, not the market driver.

6.5 Forecast Uncertainty Band (Market Risk Range)

Because commodity markets are not linear, the forecast must include a realistic uncertainty corridor.

The uncertainty band reflects:

Demand variability (tenders, seasonal slowdown)

Supply discipline (availability of export cargoes)

Freight/logistics constraints

Competitive pressure from neighboring producers

Practical Forecast Trading Band (Next 2 Months)

A realistic market corridor is:

Low case: 360–365

Base case: 368–375

High case: 380–390

Thus, the next two months are likely to remain in a higher plateau regime, not a return to early-December levels.

6.6 Scenario Outlook (Professional Market Lens)

Scenario 1 — Baseline Firm Market (Most Likely)

Probability: ~55–60%

Triggers:

Demand stays steady

Supply remains disciplined

Sellers defend higher offers

Prices grind upward gradually

Outcome:

Bulk stabilizes in the high-360s / mid-370s

Packaged material follows premiums

Scenario 2 — Bullish Upside Acceleration

Probability: ~25–30%

Triggers:

Export demand spike (India, East Africa, GCC pull)

Short-term supply squeeze

Refinery maintenance limiting output

Strong tender cycle in February/March

Outcome:

Bulk tests 385–390 USD/MT

Drum approaches 425+

Jumbo approaches 415+

In this case, the market becomes seller-controlled and validity periods shorten.

Scenario 3 — Bearish Consolidation / Correction

Probability: ~15–20%

Triggers:

Seasonal demand pause

Buyers resist higher numbers

More cargo availability enters the market

Competitive pricing from Iran/Bahrain

Outcome:

Bulk consolidates around 360–365

Market trades sideways rather than collapsing

Packaging premiums remain stable

Important:

> Even in the bearish case, the market does not strongly revert to 320–330 unless demand collapses.

6.7 Key Forecast Implications for Buyers and Sellers

If You Are a Buyer

The market is in an upward regime — delaying purchases increases exposure

Consider staggered buying instead of waiting for a reversal

Jumbo may offer the best cost-handling compromise

Use the lower band (360–365) as a tactical entry zone

If You Are a Seller / Exporter

Bulk should remain the anchor of your pricing strategy

Maintain premiums structurally (Drum +40, Jumbo +30)

In bullish windows, shorten validity and defend upside

Late-January behavior suggests buyers have accepted higher re-anchoring

6.8 Strategic Conclusion

The Iraq bitumen FOB market has shifted into a higher pricing regime.

The evidence strongly supports:

A sustained firm structure

Continued upward drift rather than reversal

Packaging spreads remaining stable

Bulk being the dominant driver of risk

Most Probable Outcome

Over the next 1–2 months:

Bulk trades mainly in 368–375 USD/MT

Drum trades mainly in 408–415 USD/MT

Jumbo trades mainly in 398–405 USD/MT

With upside risk toward 385–390 if tightening intensifies.

7) Scenario Framework (Professional Market View)

Baseline scenario (trend continuation): The market keeps appreciating gradually; offers re-anchor higher and buyers accept. Outcome: Bulk drifts upward along the baseline forecast; packaged prices follow via stable premiums.

Bull scenario (tightness intensifies): A short supply squeeze or demand burst accelerates price beyond the trend. Outcome: Bulk reaches the upper band sooner; sellers add firmness and shorten validity; premiums may expand slightly if packaging capacity tightens.

Bear scenario (consolidation/retracement): Demand pauses or supply loosens; buyers resist higher levels. Outcome: Bulk trades sideways or slips toward the lower band; discounts reappear; premiums generally stay stable unless packaging costs spike.

8) Charts

9) Tactical Recommendations (Buying/Selling)

If you are BUYING:

• Use the baseline forecast as the expected drift; bid closer to the lower band when supply options exist.

• If project timing is rigid, lock volumes earlier (or stagger purchases) to reduce exposure to upward drift.

• Jumbo often delivers a cost/handling compromise vs Drum; re-run the delivered-cost model per destination and container plan.

If you are SELLING:

• Keep bulk as the anchor: quote packaged material as Bulk + premium, updating bulk first.

• In tightening windows, shorten validity and protect upside with escalation clauses or indexed re-pricing.

• Defend higher levels when spot availability is limited; the dataset suggests the market has accepted sequential re-anchoring.

Limitations & what improves forecast quality:

• With more observations (weekly or daily), you can shift to ARIMA/ETS or regression with crude/fuel-oil proxies.

• Adding real drivers (export tenders, refinery output, freight) enables scenario probabilities and better risk bounds.

10) Conclusion

Over the last two months, the Iraqi bitumen export market has experienced a clear and sustained upward repricing trend, moving from a relatively balanced level in early December into a noticeably firmer pricing regime by late January. The available data indicates that FOB Bulk prices increased from approximately 320 USD/MT at the beginning of the period to around 360–363 USD/MT by the end of January, representing a net appreciation of roughly +40 USD/MT (about +13% growth in less than two months). This scale of movement reflects not short-term noise, but a structural tightening in the market.

The price evolution has followed a staircase-like pattern, characterized by sequential weekly increases rather than sharp volatility. This behavior is typical of a market where sellers progressively test higher offer levels and buyers continue to accept new anchors, suggesting strengthening export demand and disciplined spot supply availability. The late-January acceleration is particularly important, as it signals a shift into a higher plateau where sellers hold stronger pricing power.

From a packaging perspective, the relationship between Bulk and packaged products remains stable. Drum material consistently trades at an implied premium of roughly +40 USD/MT above Bulk, while Jumbo Bag trades at approximately +30 USD/MT above Bulk. The stability of these premiums indicates that most of the market risk and price direction is driven by underlying Bulk fundamentals, while packaging remains largely a fixed logistical add-on rather than a separate pricing driver.

Looking forward, the baseline forecast suggests that Iraqi Bulk FOB prices are likely to remain firm, with gradual appreciation continuing into the next 6–8 weeks. The most probable trading corridor places Bulk in the range of 368–375 USD/MT, with Drum tracking around 410–415 USD/MT, and Jumbo Bag around 400–405 USD/MT. Upside risk exists toward the 385–390 USD/MT zone if export demand strengthens further or supply tightness intensifies. Conversely, even under a softer demand scenario, the market is expected to consolidate near 360–365 USD/MT rather than reverting to early-December levels.

Overall, the Iraqi bitumen market has entered a stronger pricing environment where upward drift remains the dominant bias. Buyers face increasing cost exposure if procurement is delayed, while sellers are positioned to defend higher offer levels as long as supply discipline and export demand remain supportive. The key conclusion is that Iraq FOB bitumen pricing has structurally shifted upward, and the near-term outlook remains firm with continued bullish momentum.

By Bitumenmag